Will DEA Rescheduling Fix Cannabis Payment Processing?

Federal cannabis policy is evolving, but rescheduling does not automatically resolve the regulatory and financial challenges dispensaries face, particularly around banking and payments.

As cannabis legalization expanded across the United States over the years, dispensaries have operated inside a persistent contradiction. They are legal businesses under state law, licensed and regulated, employing thousands and generating billions in revenue, yet they remain largely excluded from the federal systems that support modern commerce.

That tension shifted in December 2025 when the Trump Administration signed an executive order directing federal agencies to reschedule marijuana under the Controlled Substances Act. The order formally began the process of moving cannabis out of Schedule I and into a category reserved for substances with a moderate to low potential for dependence, placing it alongside drugs such as Tylenol with codeine.

The action did not legalize recreational marijuana at the federal level. Cannabis remains illegal under federal law, and states continue to regulate sales independently. But the distinction matters. Rescheduling changes how cannabis is defined and treated across federal agencies, and it signals a meaningful shift in how the government views the industry.

The rescheduling process is being fast-tracked into 2026, and while implementation will take time, its implications are already shaping how operators think about taxes, banking, insurance, and long-term stability. For dispensaries, the question is immediate and practical: does rescheduling finally fix cannabis payment processing?

What the Executive Order Actually Changes

Rescheduling acknowledges accepted medical use and places cannabis within a regulatory framework that more closely resembles other controlled substances already integrated into the U.S. economy. That shift is expected to have significant downstream effects.

Most notably, it is anticipated to normalize business tax treatment by removing the burden of IRS Code 280E, which has long prevented cannabis businesses from deducting ordinary operating expenses. It is also expected to improve banking access by reducing the compliance friction that has kept many financial institutions on the sidelines. Over time, it may help stabilize the insurance market, where cannabis operators have historically faced higher premiums and fewer coverage options due to federal classification risk.

These changes are meaningful. They address structural barriers that have made it harder, and more expensive, to operate a cannabis business compared to other regulated industries.

But payment processing does not operate on tax code alone.

Why Rescheduling Doesn’t Automatically Fix Payments

Electronic payments depend on a complex network of private institutions, including issuing banks, acquiring banks, and card networks such as Visa and Mastercard. These entities are not governed solely by the Controlled Substances Act. They operate under layered risk models, federal banking regulations, and internal compliance standards that evolve cautiously, especially in industries still considered high risk.

Rescheduling does not automatically rewrite card network rules. It does not require banks to onboard cannabis merchants. And it does not eliminate enhanced monitoring for industries that remain federally illegal outside of narrow medical contexts.

In practice, this means that while rescheduling improves the long-term outlook, it does not instantly unlock traditional credit card processing for dispensaries. The payments infrastructure moves more slowly than policy headlines, and financial institutions will continue to evaluate cannabis through a risk-based lens.

Legality and bankability are related, but they are not the same thing.

Why Cannabis Will Likely Remain “High Risk” for Now

Even after rescheduling, cannabis is expected to remain classified as a high-risk industry by banks and processors in the near term. That designation reflects regulatory complexity, dispute exposure, and reputational considerations rather than moral judgment.

As electronic payment adoption increases in dispensaries, financial institutions are already seeing higher transaction volumes, and with them, increased scrutiny around fraud, chargebacks, and compliance controls. In many cases, cannabis merchants face tighter thresholds and faster intervention than traditional retailers.

Rescheduling may improve perception over time, but it does not immediately recalibrate the risk models used across the payments ecosystem. Dispensaries should expect continued expectations around documentation, transparency, and monitoring, particularly as regulators and banks adjust to a rapidly evolving landscape.

Why Debit-Based Solutions Will Continue to Dominate

As federal policy evolves, debit-based payment solutions are likely to remain the most viable electronic option for dispensaries in the near future. These systems align more closely with existing banking frameworks and allow for clearer audit trails, which financial institutions prioritize when managing compliance exposure.

Debit transactions also tend to carry lower chargeback risk than credit cards, an increasingly important consideration as dispute volumes rise across high-risk retail categories. While rescheduling may accelerate innovation, it does not eliminate the need for carefully structured, compliant payment solutions built specifically for cannabis.

What Dispensaries Should Be Preparing for Now

Rescheduling represents progress, but it also signals increased attention. As cannabis becomes more normalized, financial institutions are likely to demand cleaner reporting, clearer transaction data, and more consistent operational controls.

Dispensaries that are relying on fragile or opaque payment setups may find themselves exposed as scrutiny increases. The merchants best positioned for 2026 and beyond will be those that treat payments infrastructure as a core business function, not a workaround.

This is the moment to evaluate whether your payment system is built for stability, compliance, and growth under shifting federal policy.

The Blunt Truth

Federal cannabis reform matters. Rescheduling is a meaningful step forward. But when it comes to payment processing, there is no single policy decision that instantly resolves years of financial complexity.

Dispensaries that succeed will be the ones that understand the gap between headlines and infrastructure and choose partners who operate in today’s regulatory reality while preparing for what comes next.

Because in cannabis payments, the most important question isn’t what might change tomorrow. It’s whether your payment system works today, reliably, compliantly, and without putting your business at risk.

Where Valor Fits In

Valor Payments works with cannabis businesses under current U.S. policy, not future promises. Our solutions are designed to operate within existing banking frameworks while helping merchants prepare for industry evolution.

As federal policy shifts, having a payments partner that understands both regulation and real-world operations isn’t optional. It’s essential.

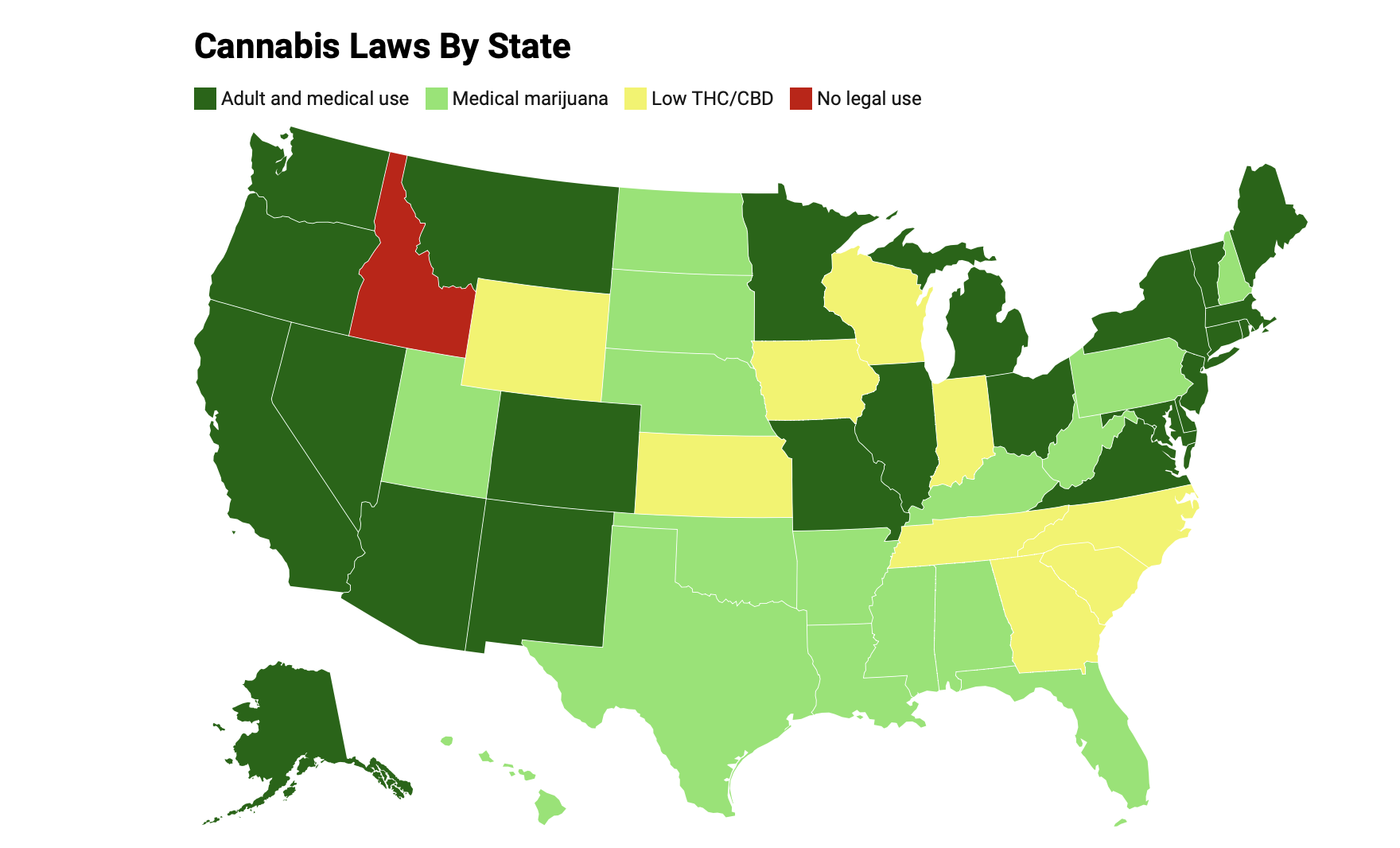

Map: Will YakowiczSource: National Conference of State Legislatures and Marijuana Policy ProjectGet the dataCreated with Datawrapper